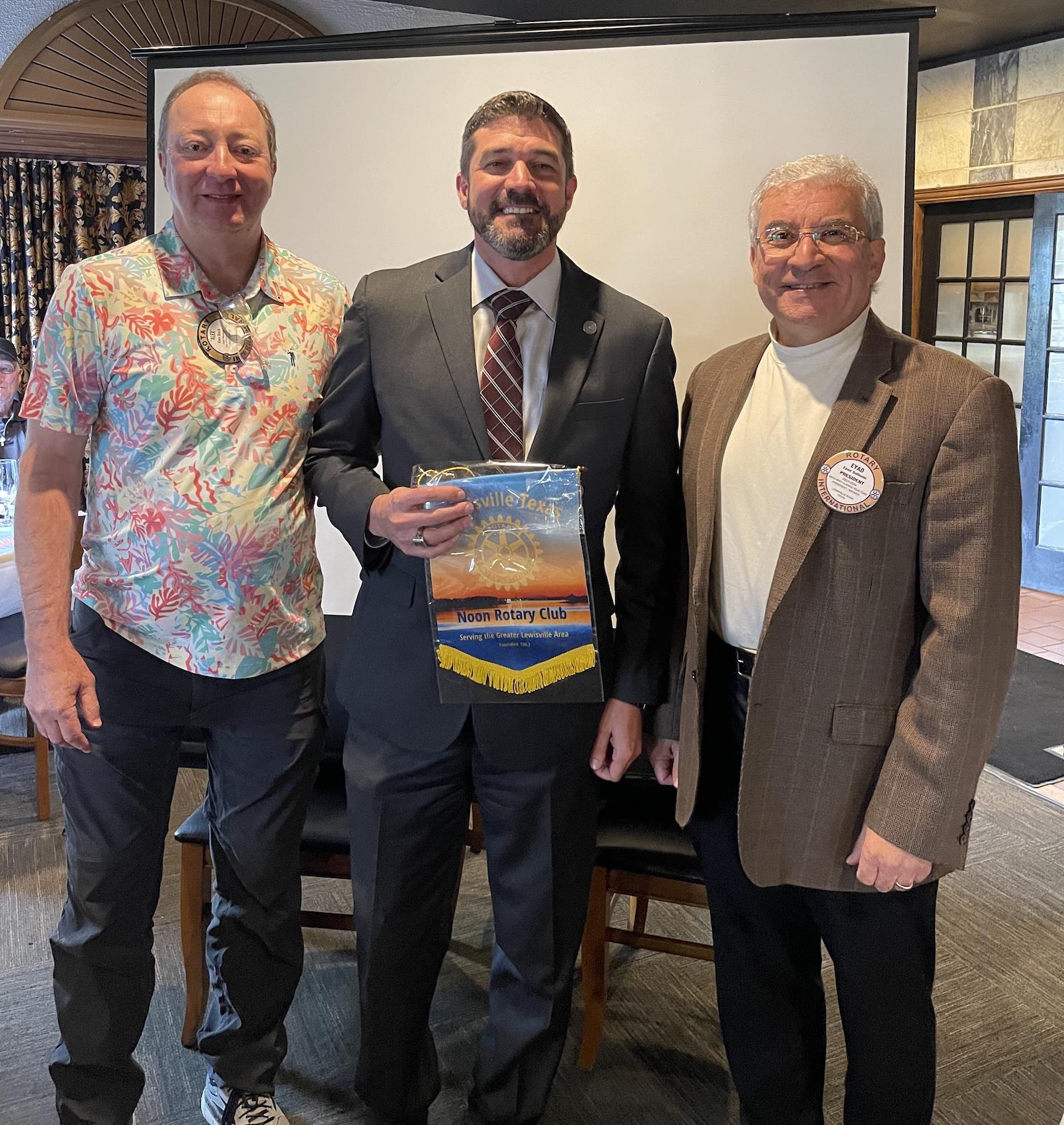

L to R: Rotarian and program host Alex Buck, guest speaker Don Spencer of the DCAD, and LNR president Eyad Salloum. Click photo above to open full-size image.

Guest presenter Don Spencer, chief appraiser for DCAD (Denton County Appraisal District), last week gave members of the Lewisville Noon Rotary club a valuable primer on the role of the the county appraisal office and how property taxes are calculated.

Property taxes help fund numerous services from which local residents benefit, and the DCAD is responsible for determining a fair and uniform value of each property within the county. Denton County has experienced rapid growth over the last seven years, Spencer noted, and homeowners' tax dollars help ensure the infrastructure can keep pace.

The appraisal district was established in 1980 through legislature to separate the appraisal process from the actual tax assessment, Spencer explained. Although the County Appraisal District plays an important role in local government, it is not the taxing authority. The taxing entities (county, cities, schools, and special districts) set the tax rate which determines how much property tax each property owner will need to pay.

The appraisal district was established in 1980 through legislature to separate the appraisal process from the actual tax assessment, Spencer explained. Although the County Appraisal District plays an important role in local government, it is not the taxing authority. The taxing entities (county, cities, schools, and special districts) set the tax rate which determines how much property tax each property owner will need to pay.The DCAD serves all property owners in Denton County, as well as the special utility district and the county's 234 taxing units. Notices for property tax appraisals go out on April 5th, and property owners have until May 15th to protest the appraisal, if they believe the valuation is inaccurate. For more information, check out the Frequently Asked Questions on the DCAD website.